Xero Salesforce integration: How to automate invoices and payments

Sales and finance teams often work towards the same goal, but from different perspectives. The thing is, teams use different tools for their work. Sales teams rely entirely on Salesforce, while finance teams track payments and reconcile numbers in Xero. To communicate, they often copy or retype data, which causes delays and errors and slows everything down. Such inefficiencies cost real money: you get duplicate records, invoice discrepancies, and missed reporting deadlines.

Meanwhile, 95% of companies that fully automate their accounts payable report healthier finances overall, citing better accuracy and shorter payment cycles. The logic is simple. When data flows seamlessly between the systems that record a sale and the systems that record money, human error becomes the exception rather than the norm. So, when Salesforce and Xero are connected, the entire cycle changes. Closing a deal in Salesforce allows users to create an invoice in Xero. After receiving payment, the status will be updated in Salesforce automatically. This gives both teams an instant and accurate view of the same information.

In this article, we’ll explore how Xero Salesforce integration helps automate workflow around invoicing and payment tracking by syncing data between two systems, and why many companies need it. We’ll also take a closer look at existing solutions, as well as what best practices and pitfalls to look out for.

What Xero and Salesforce integration actually does?

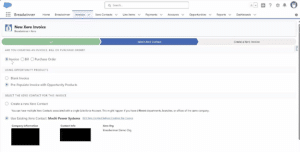

Integrating Salesforce with Xero means bringing together your customer, sales, and financial data into one seamless workflow. Teams can easily view and manage Xero invoices directly from Salesforce. When an opportunity is closed, users can quickly create an invoice in Xero using accurate customer, product, and pricing data pulled from Salesforce.

This is how you get a structural shift to real-time finance. With automation, invoices will require less of the user’s time. Payment statuses reflect reality, not guesswork, and forecasting moves from reactive to predictive.

Common integration options

So, if you are ready to start automating your processes, you might have some questions. Does Salesforce integrate with Xero flawlessly? You will definitely need help, but there are several ways to integrate Salesforce with Xero:

So, if you are ready to start automating your processes, you might have some questions. Does Salesforce integrate with Xero flawlessly? You will definitely need help, but there are several ways to integrate Salesforce with Xero:

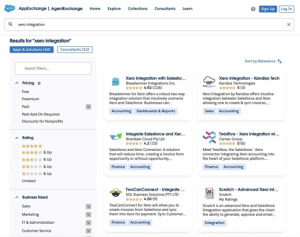

- Pre-built connectors like Breadwinner, which is available on the Salesforce AppExchange. It is usually quick to deploy and reliable for most setups.

You can also choose another connector from the options offered on the AppExchange if it better suits your needs.

- Automation platforms such as Zapier or Workato. They can handle more flexible workflows involving multiple systems. However, it will require more time and most likely a specialist to make all the necessary configuration changes.

- Custom integrations via API. This is a costly way that will need a dedicated team, but it fits companies with complex billing rules or unique data structures.

Each approach differs in setup time and control, but in the end, you get what you need: a single, automated process connecting two vital parts of the business. For this guide, we decided to stay with Breadwinner to demonstrate how invoice creation between Salesforce and Xero can be managed directly from Salesforce in a simple and reliable way.

The most common use cases of invoices and payments automation

So the goal of Salesforce to Xero integration is that when someone enters or updates something in one system, the relevant outcome happens automatically in the other. Here are some areas where changes will have almost an immediate effect:

So the goal of Salesforce to Xero integration is that when someone enters or updates something in one system, the relevant outcome happens automatically in the other. Here are some areas where changes will have almost an immediate effect:

- Invoice creation from deals. When a deal in Salesforce moves to “Closed Won,” users can generate an invoice in Xero directly from the Opportunity. The invoice pulls in all relevant customer, product, and pricing details from Salesforce, reducing manual data entry and ensuring accuracy between systems.

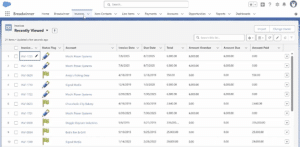

Bi-directional updates. If a customer record is updated in Salesforce (address, contact name, etc.), it flows to Xero. Similarly, if a payment in Xero is marked complete, that status updates in Salesforce, so your sales team sees which invoices are paid or overdue.

Bi-directional updates. If a customer record is updated in Salesforce (address, contact name, etc.), it flows to Xero. Similarly, if a payment in Xero is marked complete, that status updates in Salesforce, so your sales team sees which invoices are paid or overdue.- Multi-currency and tax support. If your business operates across borders, you’ll often need invoices in different currencies, with different tax codes. A good integration handles these seamlessly, so you don’t have to juggle exchange rates in spreadsheets.

- Dynamic line items and discounts. Sales sometimes include multiple products, service lines, discounts, or custom pricing. The integration should map and transform those details cleanly.

- Reporting from a unified data set. Once invoices and payments are synced, revenue reports, aging summaries, forecasting, and pipeline management all draw from the same source. You stop guessing; you start seeing.

In practice, it changes how your teams work. The sales rep doesn’t wait for finance to catch up. The finance team doesn’t wait for the sales team to send an export. Instead, both see the same truth as close to real time as possible.

How does Xero integrate with Salesforce?

While Salesforce and Xero integration starts with clicking “install”, it requires thorough planning and preparation. We’ve created a short narrative-style step-by-step guide on how a company might do it well.

1. Start with data hygiene and planning

Before launching a connector, you must do several pre-install steps. Clean up duplicate contacts and standardize naming conventions to fully sync the data. Do not forget to verify your tax and currency settings. Decide which fields matter: discounts, payment terms, shipping address, etc. Choose who approves invoices or handles exceptions.

2. Pick your integration method

Many companies start with pre-built connectors; for example, Breadwinner is quick to install and easier to configure. If your organization has more complex needs (e.g. layered pricing, project billing, multiple legal entities), you may opt for middleware platforms or a custom API.

3. Test with a small batch

Don’t flip the switch for your entire business on day one. Pick a subset of customers, or a single sales team, and run deals through the integration. Watch how fields map and how rounding works. At this stage, you might see some errors in the Xero to Salesforce integration or some mistakes made on the previous step.

4. Train your people

Have sales and finance sit in the same room and walk through the workflow. Show sales how to review invoice status, show finance how to see exceptions. You’ll need to explain how updates in one system reflect in the other. Organize some training and a QA session to make sure the whole team is on one page.

5. Monitor, refine, expand

Use sync logs and error reports to catch mismatches or failures. Over time, expand coverage (e.g. more product lines, more currencies, more geographies). Run periodic data audits to ensure the systems stay in alignment.

Clearly, this guide is approximate and contains only the basic steps. You may need additional steps depending on the complexity of the system and your internal document flow. Nevertheless, through that approach, the Salesforce integration with Xero becomes less of a project and more of a new operating rhythm.

Security and compliance: Trust at the core of integration

Bringing Salesforce and Xero together can feel like connecting two halves of your business brain. But once data starts moving between them, one question becomes unavoidable: how safe is it?

These systems handle some of your company’s most sensitive information, and a single security lapse can ripple through both teams. That’s why, before celebrating automation gains, it’s worth pausing to think about how your integration protects that data and whether it meets today’s compliance standards.

Data security during sync

To stay secure, you should use trusted integration tools that follow Salesforce’s security standards and don’t store your financial data outside your org. For example, Breadwinner is a 100% native Salesforce app with enterprise-grade security built in. This ensures that customer and financial information cannot be intercepted or viewed by unauthorized parties. Authentication protocols verify each user’s identity before any connection is made, and permission controls define exactly which records each role can view or modify.

To maintain this protection, access levels and integration settings should be reviewed regularly, especially after role changes or staff turnover. These reviews help prevent outdated permissions or inactive accounts from becoming weak spots in your system.

Regulatory compliance

Integrating sales and finance systems also means that data management should comply with legal and industry standards. Frameworks such as GDPR, CCPA, and other financial reporting requirements dictate how companies must collect, process, and store personal and transactional data.

Both Salesforce and Xero support compliance with detailed audit trails, version tracking, and data security policies. However, the ultimate responsibility lies with your organization. Teams should establish internal procedures for data retention and access control.

Building a culture of secure integration

Security and compliance work best when viewed as ongoing practices, not one-time configuration tasks. Regular audits, updated user training, and communication between sales and finance guarantee everyone understands how to handle data responsibly.

Typical challenges and how to mitigate them

According to The State of SaaS Integrations Report by PartnerFleet, Paragon, and PartnerStack, 84% of businesses view integrations as “very important” or even a “key requirement” for their customers. Unfortunately, recognizing the importance does not make the integration of the two systems any easier. Integrating Salesforce and Xero can come with its own set of challenges. Differences in data structures, field mappings, and process logic may cause errors or delays if not properly managed.

| Challenge | Possible solutions |

| Data mismatches (e.g. duplicate customers, inconsistent address formats) | Run data cleansing before syncing; possibly do a reconciliation of master data; require certain data fields (e.g. billing address, tax ID) before the invoice trigger. |

| Multiple currencies or variable tax regimes | Make sure the integration tool supports multi-currency, tax code mapping; test when currencies fluctuate. |

| Workflow complexity (e.g. discounts, custom line items, approvals) | Use tools that allow custom workflows; build in approval steps or manual override where needed. |

| Maintenance & versioning | Monitor updates from both Salesforce and Xero; plan for API version changes; ensure your integration tool has support/maintenance. |

With tools like Breadwinner, the process becomes much easier. It provides a direct connection between Salesforce and Xero, handling most of the complexity behind the scenes. It helps keep data consistent, reduces manual work, and ensures that your sales and finance teams always have access to the same up-to-date information.

Conclusion: From optional to mandatory

In the larger context, integration is a step towards a broader financial transformation. It connects customer experience with financial reality, transforming disparate systems into a holistic picture of the business.

Automating invoices and payments through the Xero and Salesforce integration is one of the most visible and measurable results of this transition. You get immediate reductions in manual work, errors, and processing time. It’s also a cultural shift in how companies process their financial data.

The distance between a signed deal and a received payment used to be measured in emails and spreadsheets. Now it can be measured in seconds. As more companies make this leap, Salesforce and Xero integrations are likely to become the norm, not the exception. Eventually, it will turn into a quiet background process that keeps the gears of commerce turning smoothly while people focus on the work that actually drives growth.