2023 European Banking Outlook: strong ships in turbulent waters

Visibility as we enter 2023 is extremely low, owing to a cocktail of uncertainties around the policy mix and geopolitical factors. Nonetheless, we paint a benign base-case picture for banks despite the deteriorating macroeconomic environment.

“As opposed to previous crises, banks’ anti-cyclical features – namely the positive gearing of revenues to rising interest rates – will be on display,” said Marco Troiano, head of financial institutions at Scope. “In our base case, margins will expand significantly, more than offsetting a somewhat weaker performance of fee and commission income and somewhat higher provisioning.”

Profitability will end up at similar levels to 2022 but with very different drivers. Top lines will benefit from expanding banking margins on the back of a more supportive-interest rate environment but they will be less and less boosted by artificial TLTRO carry-trade earnings.

Net interest margins are due to expand in 2023

Note: net interest margins calculated on total interest-earning assets.

Source: Scope Ratings

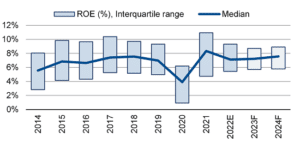

ROE expectations 2022-2024

Source: Scope Ratings

Rising wholesale funding costs, partly reflecting greater issuance in a more expensive market to meet fully-loaded MREL requirements (applicable from January 2024) will weigh on revenues. “After many years of a deflationary or at best disinflationary environment, banks will have to deal with rising wage demands driving up their cost bases but also facilitating over-capacity management. In addition, the decade-long improvement trend in asset quality will go into reverse.”

Troiano believes the deterioration in the macroeconomic environment, high energy prices and rising debt-servicing costs will lead to new NPL formation, requiring banks to set aside provisions for loan losses. “The increase in cost of risk should be manageable, though, in the context of expanding pre-provision profits,” he said.

Liquidity metrics will deteriorate (from very strong levels). “Current bank funding and liquidity ratios partly reflect structural improvements,” Troiano continued, “as banks adapted their liability structures to the post-GFC regulatory environment. But the more recent leg-up in liquidity ratios is driven by the extremely loose monetary conditions following the Covid shock, which are now going into reverse.” Scope expects Liquidity Coverage Ratios to decline as cheap central bank funding is repaid and carry trades are unwound.

Capital strength will be preserved (willingly on not). Against the more uncertain scenario, Troiano says regulatory scrutiny over capital distribution will increase and banks’ plans to distribute capital excess will be put on hold, at least temporarily. “But it is worth highlighting that, despite generous dividend distribution and share buyback programmes in 2021 and 2022, banks enter 2023 with strong capital positions and material buffers over requirements, which continues to support their credit profiles,” Troiano said.

There are some downside risks to Scope’s base-case scenario. These relate to much deeper economic contraction leading to a steep deterioration in asset quality, rising funding costs negating the effect of asset repricing, and banks failing to contain cost inflation. “Under our stressed assumptions, European bank profitability would decline materially and, in some cases, banks would post losses but capital erosion would be limited even under severely stressed scenarios,” Troiano said.