London accelerates while inflation destroys real growth

Supply shortfalls remain evident across all the English regions, Scotland and Wales, worsening the already severe property drought, according to Home.co.uk’s Asking Price Index for January.

Consequently, the total count of unsold property dropped again to a further record low this month. Demand, fuelled by artificially low mortgage interest rates, has demolished 41% of agents’ inventories over the last twelve months alone.

Of course, such an imbalance of supply and demand has meant that prices have been pushed up across the entire country. Low supply and seemingly indefatigable demand look set to persist into 2022, continuing the upward price pressure. Even the Greater London market, which suffered the most during the lockdowns, now looks very bullish with prices rising for a third consecutive month and supply falling.

Of course, such an imbalance of supply and demand has meant that prices have been pushed up across the entire country. Low supply and seemingly indefatigable demand look set to persist into 2022, continuing the upward price pressure. Even the Greater London market, which suffered the most during the lockdowns, now looks very bullish with prices rising for a third consecutive month and supply falling.

Soaring inflation means that real home price growth is less than zero overall. Only four English regions and Wales show growth over and above the latest RPI* inflation figure of 7.7% for November. However, the current level of inflation is likely to be considerably higher meaning that, at best, some regions are treading water while others are suffering significant price falls in real terms.

Whilst the prospect of negative real growth will deter 100% cash investment, the huge spread between mortgage interest rates and inflation incentivises highly leveraged investment. As inflation heads towards 10% and a 7-year mortgage deal can currently be fixed at 2%, in real terms the debt will be eroded at a rapid rate. Hence, we expect buyer demand to remain high thanks to this perverse state of affairs, ensuring that home prices will rise again strongly this year even if real growth is negative.

Scarcity is also prevalent in the rental market. The lack of rental stock is alarming but perhaps not a surprise given the multi-year assault (through regulation and taxation) on buy-to-let landlords. Moreover, it’s getting worse as the supply of rental properties falls further (overall 24% down on January 2021), making further rent hikes inevitable this year.

The greatest rent rises by far over the last year are to be found in the London lettings market. As the Covid exodus has gone into reverse, demand has returned and supply has plummeted. The result of this rapid recovery is that rents are back to pre-pandemic levels and therefore the fundamentals underpinning the value of property in the capital have been restored.

In fact, rents continue to rise in London, with every one of the 33 boroughs showing a hike in the mix-adjusted average during the last six months. Moreover, the greatest annualised rises are concentrated in the more central districts, namely the City, Westminster, Kensington & Chelsea, Hammersmith & Fulham, Camden, Tower Hamlets and Islington.

Home prices and rents will continue to rise overall in 2022 due to scarcity caused by the lax monetary policy and a disincentivised Private Rental Sector. Too much money is chasing too few properties and only a massive rise in interest rates could correct that situation and tame inflation. However, the government seems to have no appetite for curing the UK economy’s addiction to cheap credit and instead are fiddling while Rome burns.

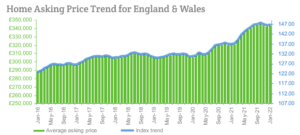

The annualised mix-adjusted average asking price growth across England and Wales remains unchanged at +6.9% this month; in January 2021, the annualised rate of increase of home prices was 4.9% and in a rising trend.